We understand the investment parents make in their child’s future when they choose to send them to a private school. The value of your investment is priceless.

Just like a potter’s hands guide and direct the final outcome of a piece of clay, a child is molded by teachers, coaches, curriculum, and peers. They learn how to think, act, and respond in a fallen world. They develop ideas about their identity, their worth, and their purpose.

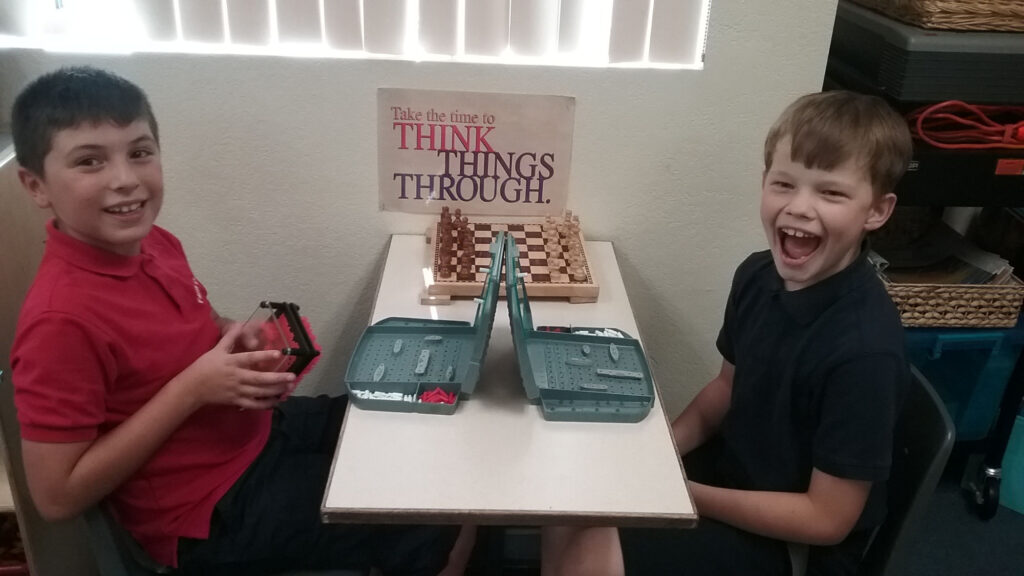

We are honored to serve Mesa and the surrounding communities by helping students grow as Christian servant-leaders and take their place as responsible members of the Kingdom of God by training the whole child to their highest academic, social, physical, creative, and spiritual potential.

While a Christian education is priceless, we know money matters.

FCS’s tuition is set to accurately reflect the cost of delivering an exceptional educational program.

Click here to request the current tuition rates and affordability options.

Thanks to various financial assistance programs, most families at FCS do not pay full tuition.

We are blessed to have programs like the Empowerment Scholarship Account (ESA) and Tuition Tax Credit that make a quality Christian education more accessible than ever.

Click here to request the current tuition rates and affordability options.

Like you, we know the most important consideration in choosing a school is what is best for your child. The best way to determine whether FCS is the right-fit for your family is to come and see us in action. During your visit, we’ll happily discuss the tuition and fees, financial aid, and affordability options.

Helping students reach their highest potential

Follow us on social media

Faith Christian School admits students of any race, color, national and ethnic origin to all the rights, privileges, programs, and activities generally accorded or made available to students at the school. Faith Christian School does not discriminate on the basis of race, color, national and ethnic origin in administration of its educational policies, admissions policies, scholarship and loan programs, and athletic and other school-administered programs.

Complete the form below to request the current tuition rates and affordability options.